Other loan providers limit the purchase day so you can months before starting an alternative reputation. We and make it team assets and you will gift financing to the off commission, closing costs and you may supplies. Zero 2-season record becomes necessary to own physicians rented as the a company or 1099 worker. Offered nationwide (except California), 2-unit features eligible, freedom to possess recently one-man shop. “Qualifying Purchases” are, but they are not limited in order to, point of sale transactions, expenses commission(s), ATMtransactions, take a look at, dollars otherwise lead dumps, and you will electronic fund transmits. Being qualified Transactionsexclude modifications, advances, reversals, refunds, account to account transmits, person-to-persontransfers, desire, service charge, and you will services fees.

A Beginner’s Self-help guide to A home Investing

The reportable transfer, a possible Reporting Individual would need to determine whether there is certainly some other prospective Revealing Individual mixed up in transfer just who consist higher in the cascade. Even if FinCEN anticipates one to potential Revealing Individuals usually correspond with per almost every other concerning your have to document research, there would be no needs to ensure one any prospective Revealing Person in fact recorded it. The fresh fund sports a reduced rate-earnings ratio than simply their Morningstar group’s mediocre. You to definitely attractive valuation gets it extra space to possess prospective speed enjoy.

Potential Charges for Low-Revelation from Overseas Possessions

No basis is actually fundamentally determinative, but acquiring a green cards (permanent household visa) essentially do https://vogueplay.com/in/queen-vegas-casino-review/ resulted in completion one a low.You.S. Citizen’s domicile are a facts-and-things analysis, personal and you will unique for the personal. The fresh generous-visibility sample, that is removed government income tax motives, isn’t associated in the devotion of a non.U.S.

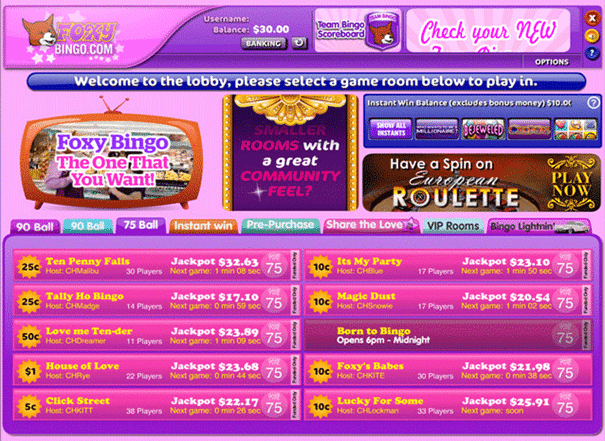

Among other things, group will get a regular serving out of articles to the most recent casino poker development, live revealing from tournaments, private video, podcasts, analysis and you may bonuses and so much more. Most bonuses interact with giving professionals a lot more, free finance to play with. Such as, a one hundred% put bonus will be in which you put some dollars, let’s say $100, as well as in go back you’re going to get $200 to try out having.

Renters basically have to indication a commercial lease you to definitely information the newest legal rights and you will financial obligation of your property manager and renter. The commercial rent draft document is originate having possibly the fresh landlord or perhaps the tenant, on the conditions subject to contract between the parties. The most used form of commercial book ‘s the gross book, which includes extremely related costs for example taxation and you can utilities. A girlfriend whom will get an excellent You.S. resident by the point your estate’s federal estate tax return try owed often qualify for the fresh limitless marital deduction. The brand new come back may be due nine weeks just after dying, nevertheless the Internal revenue service get give a great half a dozen-week expansion. Because requires very long to locate citizenship—for many of us, there’s a standing period one which just implement, and it also requires at the very least period when you use—this is simply not an option for most people.

TAS strives to safeguard taxpayer legal rights and make certain the brand new Irs try applying the brand new income tax rules inside the a fair and equitable way. You should use Plan LEP (Form 1040), Request for Change in Words Preference, to say a desires to receive observes, characters, and other authored correspondence regarding the Irs inside the a choice vocabulary. You will possibly not immediately receive written correspondence on the asked language. The new Irs’s dedication to LEP taxpayers is part of a great multiple-season timeline one to began getting translations within the 2023. You will continue to discover interaction, along with notices and you will letters, within the English until he or she is interpreted to your popular vocabulary.

Canadian enterprises must file Form 1120-F and you may Function 8833 to help you allege an exemption out of tax to own payouts off their operating earnings. Canadian companies is actually at the mercy of section step 3 withholding to your leasing costs on the usage of such devices in america and you will could possibly get allege an exclusion to your Setting W8-BEN-E. Certain income tax treaties provide a restricted different of You.S. income tax and out of withholding to the payment paid so you can nonresident alien pupils otherwise students while in the training in the us for a limited several months. At the same time, particular treaties render a different from taxation and you will withholding for compensation repaid by U.S.