Blogs

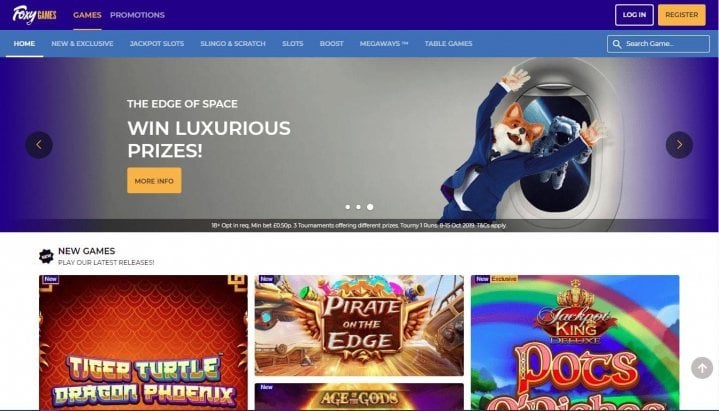

To your and you will immediately after January 1, 2012, the rate for each calendar year will likely be not less than the brand new deposit directory, while the laid out inside area 36a-twenty-six, for this 12 months. To the anniversary date of your own tenancy and you will annually after that, such as interest will likely be paid for the occupant otherwise citizen otherwise credited for the the following rental fee owed from the tenant otherwise resident, while the property manager or holder should determine. Focus will not be repaid to help you a renter for your month the spot where the renter could have been unpaid for more than ten days regarding the percentage of any monthly rent, unless the new landlord imposes a later part of the fees for including delinquency. Zero property manager should enhance the lease due out of an occupant since the of one’s needs that the property manager pay to the desire the safety put. The subscribed and you may controlled on-line casino operating in the us requires the absolute minimum deposit before you start with genuine-money gaming.

Dollar Deposit Gambling enterprises 2025

The newest FDIC guarantees the total balance from Bob’s dumps throughout these certain senior years account as much as $250,100, which renders $5,100000 from their deposits uninsured. FDIC insurance talks about depositor membership at each covered financial, money-for-dollars, along with prominent and any accumulated attention from the go out of the covered financial’s closing, up to the insurance limitation. Any person otherwise entity can have FDIC insurance rates inside a keen covered financial. A man shouldn’t have to end up being a great You.S. resident or citizen to have their particular dumps insured because of the the brand new FDIC. 5.00%Yearly Percentage Yield (APY) is direct as of Summer seventeenth, 2025. Some associations are able to increase the amount of FDIC coverage to suit your dumps because of the sweeping the fresh places for the some other using banking institutions.

- Normally, in any sleeve’s length purchase, the fresh parties is free to discuss because they want to and also the courts will not affect the new functions’ conclusion.

- If we accidently credit your bank account to have money to which your commonly the new rightful proprietor, we could possibly subtract that money from your account, even when this causes your bank account as overdrawn.

- Sure, Cds are federally covered around the maximum, $250,100 for every membership manager.

- Winnings typically take to step 1-three days to techniques just before it’lso are provided for your account.

- FDIC deposit insurance rates covers your finances inside deposit membership during the FDIC-insured banks and you can deals contacts in the event of weak.

Exactly what are POD/ITF and you will a proper revocable believe profile

It indicates the brand new publicity pays aside immediately after an accident your result in, however, just up to the amount stated in the coverage. For many who result in other crash, the fresh visibility often, again, pay to one coverage limit. Possessions destroy liability covers injury to almost every other automobiles, houses and you may structures, such as walls and phone poles.

More distressful than just paying a charge for highest cash places is the probability of raising a brow for the national. It indicates finances try stored during the financial https://happy-gambler.com/vegasplay-casino/ institutions within our network that offer FDIC insurance (at the mercy of appropriate limits). There are no additional fees to maintain Innovative Bucks Deposit since the a settlement money choice.

You might have a joint checking or savings account that have a great spouse otherwise an aging father or mother. For individuals who look after higher stability in your bank accounts, it’s important to recognize how your primary currency falls under the new FDIC insurance limitation. Or even, some of your dumps would be at risk if your lender happens belly upwards. Purchase $cuatro.99 during the Funzpoints after you manage a merchant account, and also you found 1,000 Fundamental Funzpoints 100percent free gamble and you may five-hundred Superior Funzpoints to have award prospective betting.

banking basicsWhere in order to bucks a

Inside islands such Bermuda, betting at the house-dependent gambling enterprises an internet-based are legal. This means Caribbean people can be register at the our best online sites with reduced lowest dumps today. Other islands in your community is actually well-known for certification casinos on the internet, for example Aruba and you will Curacao.

“Payable to your Death” (POD) – You can also specify a single otherwise mutual account getting payable up on the passing in order to a specified beneficiary or beneficiaries. POD membership are also also known as “Within the Trust To have” (ITF)”, “Since the Trustee For” (ATF), “Import to your Demise” (TOD) otherwise “Totten Trust” membership and therefore are influenced by applicable state laws. You are exclusively accountable for meeting certain requirements to have establishing their account while the a good POD, along with people titling criteria. A keen overdraft happens when there is no need enough money in your account to pay for a good debit exchange, but i shell out they in any event.

MaxSafe work much like CDARS, whether or not unlike putting currency to the Dvds, you could give it round the money business accounts at the 15 various other organizations. There’s a great $step 1,one hundred thousand lowest put necessary to start off there are not any month-to-month restoration charge or minimal harmony criteria. Aside from making it possible to ensure too much deposits, borrowing from the bank unions could offer other advantages. Such as, you may also make the most of large rates of interest on the put profile and you will lower costs, compared to the antique banking institutions.

The brand new FDIC makes sure deposits; examines and you will supervises creditors for protection, soundness, and you may user shelter; can make higher and you may advanced financial institutions resolvable; and you will manages receiverships. However, if with a hold placed on your bank account is a good overall inconvenience, contact your financial to see if they’re able to provide or get better some of the financing before they clear. It’s the same idea because the a money put; if you constantly don’t carry a huge harmony otherwise build high places, the lending company desires to see just what’s up. When it’s at your lender walk-inside part, your teller financial representative tend to ensure your bank account information and inquire to possess personality. As always, you’ll submit a deposit slip, and also the cash is transferred to your membership.